How to Handle a Surprise Medical Bill

The Benefit Brothers: Owners Reflect on Michigan Planners Successes Over the Years

April 6, 2022

Benefits of Paying Cash for Health Care Services – Even if You Have Insurance

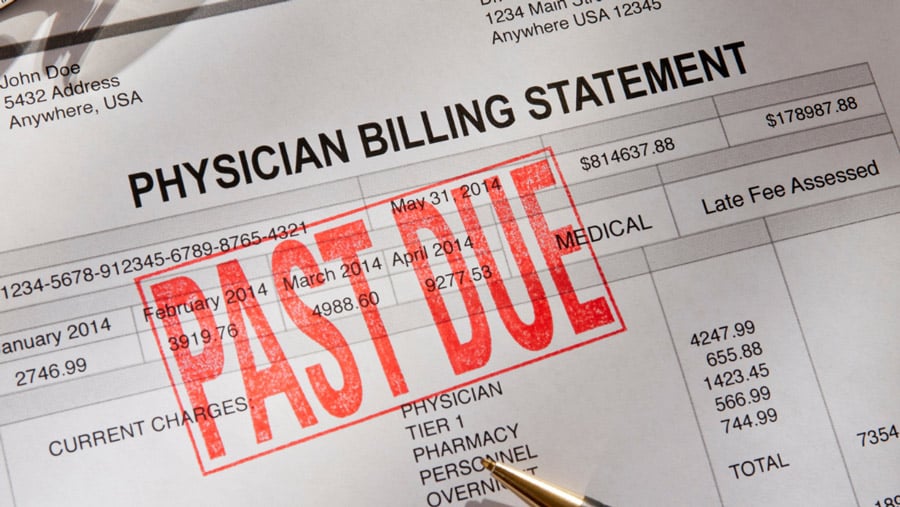

April 19, 2022| If you’ve ever received a surprise medical bill, you’re not alone. According to a survey conducted by NORC at the University of Chicago, over half of American adults have been surprised by a bill that they had assumed would be covered by their medical insurance. Moreover, only 1 in 5 of these surprise bills were the result of a patient actively seeking out-of-network care. The situation in which you would receive a surprise medical bill is commonly referred to as balance billing. This article will explain what balance billing is, how to handle a surprise medical bill and tips to help you avoid receiving one in the future. What is surprise medical billing? When you seek medical care, you often choose where you go to obtain care based on in-network providers. Choosing in-network care is typically the most affordable option. Unfortunately, even if you choose an in-network provider or care facility, you may be hit with an unexpected costly bill. This is known as a surprise medical bill or balance bill. There are typically two situations in which surprise medical billing occurs: Medical services are performed at an in-network facility by an out-of-network provider (situation includes both emergency and non-emergency services)Emergency medical services are performed by an out-of-network provider In either of these cases, while there was little patient control over provider selection, the patient will be responsible for the percentage of the bill that insurance doesn’t cover. Essentially, you’re billed the balance that remains on the bill. In the majority of cases, patients were unaware of the out-of-network provider until they received the surprise medical bill. How common is surprise medical billing? According to the Kaiser Family Foundation, out-of-network charges resulted in a surprise medical bill in 24% of emergency room services provided at an in-network facility. The same study revealed that 18%of inpatient admissions resulted in such charges as did 15% of admissions in an in-network facility. Medical services that can often result in balance billing include: Services performed by anesthesiologists, pathologists, neonatologists, intensivists, hospitalists, radiologists and ER doctorsAmbulance services, including air ambulancesPost-procedure medical equipment (e.g., crutches and wheelchairs)Services performed by a provider not chosen by the patient (lab test analysis) As previously discussed, the majority of patients didn’t know that the provider of their services weren’t in-network. In fact, 7 out of 10 individuals with costly surprise medical bills had no idea until they received the bill. The concept of surprise medical billing made the news when a Texas man suffered a severe “widow-maker” heart attack. While he made a recovery, he was hit with a startling surprise balance bill of nearly $109,000. The man’s emergency care and hospital stay totaled up to $164,941 and his insurance covered $55,840. The hospital where the man was treated was out of his insurance network, which resulted in the extraordinarily expensive surprise balance bill. The man and his insurance company fought the bill and tried to negotiate it down, and ultimately a deal was made after the story made national headlines. This man’s story is an example of what many Americans experience, especially when they need emergency care and have little to no choice in where they obtain their care or the services they need in order to save their life. Are there any laws in place to protect patients from balance billing? While not always illegal, balance billing can be incredibly frustrating and financially stressing for patients. Federal and local governments have taken strides to address the problem of surprise medical billing, but the issue still persists. Handling a Surprise Medical Bill If you’ve received a surprise medical bill, you still have options. Here are some things that you can do to try to handle your surprise medical bill: Carefully review your medical bill and your insurance’s explanation of benefits (EOB). Your EOB will explain what medical treatments or services your insurer paid for and the amount you still owe. Make sure to ask your health care provider for an itemized bill to ensure that everything you’re being billed for is a medical service that you received. With over 70,000 diagnosis and 71,000 procedure codes that providers and billing departments have to sift through when composing your initial bill, mistakes can unfortunately happen. Carefully reviewing your itemized bill can help you make sure you don’t pay for things you didn’t receive. You can obtain this itemized bill by calling the provider’s billing department and, if necessary, asking to speak to the supervisor.If you’re questioning what’s on your itemized bill, trust your gut. Run the current procedural terminology (CPT) codes from your bill in the CPT/Medicare Payment tool on the American Medical Association’s website. Common CPT code errors include billing for a private inpatient room instead of an outpatient room, double-charging for services under a bundled CPT code and again under the separate CPT code, and operating room overcharges. If you notice any errors, contact the provider’s billing office and ask to speak to the supervisor.You can also reference the facility’s pre-insurance procedure and service pricing to see if there are any discrepancies between what is on your bill and what the hospital would charge. By law, every facility must post this chargemaster online. It’s important to note that the chargemaster data doesn’t take any insurance discounts or network cost agreements into account. However, you can still get some insight into what your base charges may be.If you’ve gone through your bill and find that you still owe unexpected charges, it’s time to negotiate. Call your provider’s billing department, ask to speak to a supervisor and try to work out a deal. You may need to schedule an in-person meeting or call more than once. A Consumer Reports survey revealed that 57% of those who negotiated payment of their medical bills were successful in lowering their amount owed. While you shouldn’t expect to make your bill disappear, you should hope to find a happy medium. For example, you can ask the billing department supervisor if they would accept what your insurance is willing to pay. This way, the provider is still receiving payment for the services, but you’re not paying a large amount out-of-pocket. If you’re not comfortable negotiating with a billing department, or if you’re having a hard time striking a deal, you may want to consider hiring a medical billing advocate to do so on your behalf.Ask to work out a payment plan if you’re not able to pay your balance owed out-of-pocket. Ask the billing department if you can set up affordable monthly payments to pay off your unexpected bill amount. Many billing departments will work with you, but the only way to find out is to ask if they’ll offer that option to you. Avoiding Surprise Medical Bills While you can’t always avoid receiving a surprise medical bill, being a wise health care consumer whenever possible can help lessen the possibility that you will receive one. Of course, in an emergency and life-threatening situation, you should seek out the nearest care center. For planned medical services, you should do your due diligence and find out what is covered before you obtain those services. Never assume that just because you’re receiving care at an in-network facility that your health care provider will be an in-network provider, too. The same can be said about where you’re receiving treatment, as your provider could be an in-network provider but the facility in which you’re receiving care could be an out-of-network facility, which could result in facility charges. Asking questions about the care you need to receive can be intimidating, but doing so can help you avoid surprise medical bills. Being an informed consumer can help you make the most informed health decisions and protect your wallet. For more information on health care comparison shopping or resources on in- versus out-of-network providers, please contact HR. |

| This Know Your Benefits article is provided by Michigan Planners, Inc. and is to be used for informational purposes only and is not intended to replace the advice of an insurance professional. © 2019-2020 Zywave, Inc. All rights reserved. |