Has Hell Frozen Over?

September 30, 2015

Eenie, Meenie, Miney, Moe

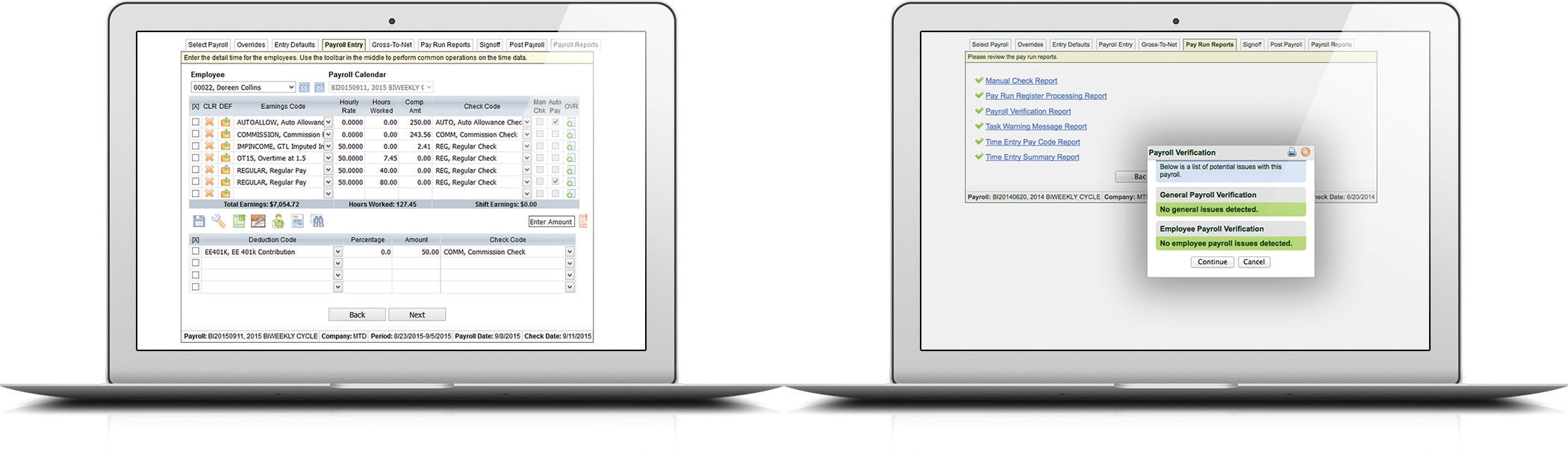

September 30, 2015Full-service payroll — Nearly everyone seems to be offering it, but what exactly is it anyway? Here’s how Michigan Planners defines full-service payroll:

Real-time payroll processing that allows you to input data, make changes, run reports and submit payroll from wherever, whenever

Complete tax and wage garnishment processing services that provides you with all pay options, manages third party payments, files taxes and reports garnishments on your behalf

Flexibility to track an unlimited number of benefit providers, benefit plans, company assets, education, skills, and organizational positions from basic demographic information and emergency contacts to full benefits management functions and regulatory requirement paperwork, such as W-4 or I-9

‘Out of the box’ functionality that is built with the end user in mind, featuring pay reports, tax reports, deduction reports, benefits reports, PTO reports, and general ledger interface reports.

Support for a multitude of accounting software integrations for general ledger imports into current accounting and ERP systems

A self-service payroll document library that was built to provide employees secured 24/7 self-service access to manage their demographic information, review and print paycheck stubs and/or direct deposit advice stubs, review reports specific to them, and manage and view W-2 information

Michigan Planners’ Full-Service Payroll and Tax Module is more than just a set of features! How about those functional items that never seem to be available to you for whatever unknown reason?

- Want to print checks on site without having to paying hefty shipping fees? – You’ve got it

- Want to VOID a check and reprocess without hefty fees? – You’ve got it

- Want to run gross-to-net tests on individual employees without having to process an entire payroll? – You’ve got it

- Want to post payments into the future while you are working on them rather than having to come back later when it may be inconvenient? – You’ve got it

- Want to change the labor allocation of a line item without having to jump through 99 hoops? – You’ve got it

- Want to process your payroll in seconds in the cloud without having to submit to a mainframe processor somewhere to get a preview? – You’ve got it

- Want to have the freedom to set up your delivery options and notifications? – You’ve got it

- Want to be able to process unlimited check types in one entry location for an employee without having to set up separate payroll calendars? – You’ve got it

- Want to preset check types that manage the applicable deductions so you don’t have to do manual work on bonus payments? – You’ve got it

- Want to actually have your 941s within days of the quarter closing and not months?– You’ve got it

- Want your deductions to be directly created from your benefits (when applicable) and eliminate another tedious and error prone step? – You’ve got it

- Want to be able to future date raises and other wage changes – You’ve got it

- Want to automate the 401k/403b logic of your business? – You’ve got it

The capabilities don’t stop there. Have a particular scenario that you want to automate? Let us know and you’ve got it. Once we show you our Full-Service Payroll and Tax Module, you’ll see why we can say that with confidence!

Consolidate ALL of your back office administration across the entire employee life cycle into a SINGLE application – which starts with Full Service Payroll and Tax solutions.

You’ve got to see it to believe it, so let one of Michigan Planners’ System Consultants walk you through a free demo of our single database, single solution today!